Heading into the next Federal Open Market Committee (FOMC) meeting slated for Dec. 15-16, investor consensus is building in favor of seeing the Fed raise the Fed Funds Rate by 25 basis points, the first increase in six years. While some pundits argue that this is the beginning of a new interest rate cycle, several Fed officials have voiced rather emphatically that any shift in fiscal policy will be largely tempered by the lagging global economy, where future growth forecasts continue to be adjusted lower.

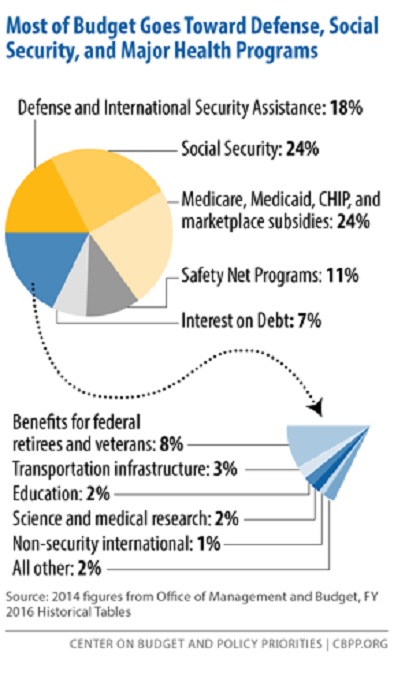

There is also the elephant in the room to grapple with, namely the $19 trillion in federal debt, of which over $6 trillion is on the books of the Federal Reserve as a byproduct of three rounds of quantitative easing (QE). Most of the debt is in the form of one-to-three-year Treasury Notes. In 2014, the federal government spent roughly 7% of its budget, or $229 billion, to service debt. The Fed can ill afford to let rates move up lest they punch a huge hole in the budget. Outside of QE, the Federal budget for 2014 was $3.45 trillion, of which $3.0 trillion was accounted for by tax revenues. The balance of $450 billion is borrowed money, which also shows the problem of unchecked government spending that will only grow worse with entitlement programs.

As many classes of dividend- and interest-paying securities have come under selling pressure for fear of being marked down further in an up-rate cycle, the evidence for that rising rate case isn’t supported by any of the inflation data where core inflation is still running at an annual pace under the Fed’s 2.0% objective. But more importantly, raising short-term rates much above 1.0% would cause interest service on the debt to skyrocket, soaking up more than 10% of the overall budget. It would only get worse in the years to come as more debt is issued to meet growing expenditures.

With this challenging scenario in plain sight, the Fed will be under tremendous pressure to maintain low interest rates at the risk of popping the debt bubble. Under this scenario, I view the sell-off in interest-rate-sensitive assets to be overdone and due for a reflex rally once the Fed has raised Fed Funds by a quarter point. The old Wall Street axiom of “buy the rumor, sell the news” works for when investors bid up stocks in front of a good news event. For yield investors, we can turn that logic around to where the market is selling the rumor (December Fed hike) and buying the news (high-yield reflex rally) in those sectors that are on sale.

This is inverse logic at work, but it is typically how the market trades as a forward discounting mechanism. I look for utilities, telecom, consumer staples, business development companies (BDCs), distressed debt and real estate investment trusts (REITs) to all enjoy nice runs higher once the Fed gets its “one and done” meeting out of the way. Being a contrarian investor is where one finds bargains when the market has overreacted. I believe this is the case for stocks and assets with yield attached to them. That being said, they should therefore present good year-end value.

In case you missed it, I encourage you to read my e-letter column from last week about the advantages offered by pipeline investments. I also invite you to comment in the space provided below.