- More Proof of Gold’s Brilliant Shine

- ETF Talk: Mining for Gold with a Triple-Digit-Percentage Gainer

- Bob Marley on Gold

*********************************************

More Proof of Gold’s Brilliant Shine

Over the past couple of months, I’ve been telling everyone I can — especially those who read my newsletter advisory services and listen to my weekly podcast — about the tremendous opportunities to be found right now in gold, silver and precious metals mining stocks.

In fact, we recently started a series in our ETF Talk segment that covers many of the best exchange-traded funds (ETFs) in the gold and mining stock space.

One reason why I am so bullish on gold, as well as the companies that dig it out of the ground, is because the global demand for gold has seen tremendous growth since the beginning of the year.

While the price chart of the benchmark gold ETF, SPDR Gold Shares (GLD), clearly shows how investors have poured into gold this year, we now have data to confirm just how strong that demand really has been.

According to a new report from the World Gold Council, gold demand reached 1,290 tons during the first quarter of 2016. That represents a 21% increase year over year, making it the second-largest quarter on record.

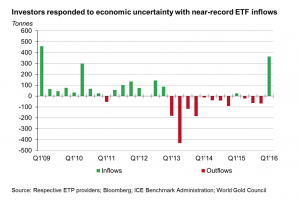

The data point I really took notice of in this report was the massive influx of capital into gold ETFs. Per the World Gold Council report, inflows into gold exchange-traded funds came in at 363.7 tons in Q1, a seven-year high which can be seen in the chart below.

If you aren’t bullish on gold after seeing data and numbers like these, I don’t know what is going to convince you otherwise.

So, how do you play the gold and precious metals mining wave from an investment standpoint? Well, the first way is to learn about all of the ETFs in the sector, and we have been making that information available to you in our ETF Talk segment for the last several weeks.

If you really want to know what advice I’m giving to investors on playing this golden bull, then I recommend you check out my Successful ETF Investing advisory service right now.

By doing so, you’ll get the power of nearly four decades of market-beating performance on your side — performance that comes complete with a proven plan on when to buy, and when to sell.

So go for the gold, and check out Successful ETF Investing today!

ETF Talk: Mining for Gold with a Triple-Digit-Percentage Gainer

If you remember my ETF Talk from last week, I showcased a silver mining fund that was up 140% as part of a new theme that focuses on mining company exchange-traded funds (ETFs). Those mining funds have seen enormous share-price appreciation in recent months due to the boom in precious metals and related sectors.

While such impressive gains are hard to replicate, I’m pleased to announce that I have found a gold mining ETF that also has seen triple-digit percentage gains so far this year. That exchange-traded fund is the Global X Gold Explorers ETF (GLDX).

GLDX started in 2010 and is part of the Global X Funds company, a New York-based provider of exchange-traded funds that offers investment opportunities in both U.S. and foreign exchanges. Specifically, GLDX provides investors with access to a broad range of companies that are involved in the exploration of suitable gold deposits through the Solactive Global Gold Explorers Total Return Index.

Year to date, GLDX’s performance has been nothing but impressive. Its share price has more than doubled since the beginning of the year, equating to about a 110% increase since the markets first opened in 2016. It is the second-best-performing mining fund year to date, beating all but the Purefunds ISE Junior Silver ETF (SILJ).

Unlike many other funds and stocks, GLDX’s chart shows no sign of a potential “bust cycle,” which can be seen as a sideways trend over time in the line tracking a fund’s share price. With $64 million in assets under management, GLDX is neither tiny nor huge, and has approximately double the assets of SILJ. The fund offers a 5.3% yield with an expense ratio of 0.65%.

View the current price, volume, performance and top 10 holdings of GLDX at ETFU.com.

GLDX’s portfolio is nearly 90% stocks, with its top 10 holdings — all related to gold and precious metals mining — comprising 68.72% of total assets. Some of the top holdings include First Mining Finance Corp., 13.20% of assets; Sabina Gold and Silver Corp., 8.26% of assets; and Oceana Gold Corp., 6.84% of assets.

If the prospect of investing in gold and silver mining companies excites you, then I’d recommend checking out the Global X Gold Explorers ETF (GLDX) further.

If you want my advice about buying and selling specific ETFs, including appropriate stop losses, please consider subscribing to my Successful ETF Investing newsletter.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an e-mail. You just may see your question answered in a future ETF Talk.

Bob Marley on Gold

“Don’t gain the world and lose your soul; wisdom is better than silver or gold.” — Bob Marley

The great reggae musician Bob Marley touched the hearts of millions with his soulful sound. Yet, he reminds us here that the pursuit of silver and gold (i.e. wealth) is not as important as cultivating wisdom. While having wealth can give one the resources he needs to become the best person possible, wealth without wisdom is not the way to increased happiness.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Doug.

All the best,

Doug Fabian