There are a whole lot of billionaires bearish on the equity markets right now.

That bearishness is understandably born out of a sense of unease about this market, a market that’s feeling way too “toppy” and way too overbought.

So, who are these bearish billionaires? Well, the list reads like a who’s who of American finance geniuses.

Here’s a sample of the biggest names who have come out with warnings that this market is headed for trouble, as laid out by the smart folks at Zero Hedge.

- Stan Druckenmiller (May 4 at the Ira Sohn Conference): “Get out of the stock market.”

- George Soros (June 9, as reported in the Wall Street Journal): “The billionaire hedge fund founder and philanthropist recently directed a series of big, bearish investments, according to people close to the matter.”

- Carl Icahn (June 9, on CNBC): “I don’t think you can have (near) zero interest rates for much longer without having these bubbles explode on you” while also saying it’s difficult to assess when exactly that might occur.

- Jeff Gundlach (last Friday, in an interview with Reuters): “Sell everything. Nothing here looks good.”

- Bill Gross (in his monthly investment letter, released last week): “I don’t like bonds. I don’t like most stocks. I don’t like private equity.”

Yes, I’ve heard the old adage that you should never argue about money with anyone richer than you. But the fact is that despite these high-profile bearish calls, they have all been wrong… at least so far.

If fact, being long in this market during its post-Brexit spike has been great for most investors, including subscribers to my Successful ETF Investing newsletter.

One reason we’ve done well of late is because we are letting the trend-following rules of what we call the Fabian Plan dictate what actions we take with our money.

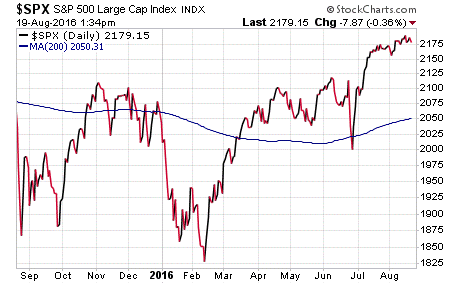

Right now, the plan rules are in “buy” mode, meaning we will continue to hold stocks as they make new highs. If and/or when stocks pull back below key trend support at the 200-day moving average, that will be the time when the market tells us that it’s time to take some risk off of the table.

This trend-following approach is your best way to “outsmart” the billionaire bears, and the beauty of the approach is that it relies purely on objective price analysis. That means you don’t have to second guess the market… you just have to respect its decisions.

Right now, those decisions are sending stocks higher in spite of the warnings from Wall Street’s elite. And until such time as a change needs to be made, we will keep betting on the wisdom of the crowds and keep profiting from the push to all-time highs.

If you want to find out how to put a proven, trend-following plan in place that puts your money to work when things are good, and gets your money on to the safety of the sidelines when things are rocky, then I invite you to check out Successful ETF Investing today.

Robbins on Success

“The path to success is to take massive, determined action.”

— Tony Robbins

The motivational guru is a personal mentor of mine, and I love the way he simplifies and clarifies things in the service of achievement. Here, Robbins reminds us that it takes nothing short of a herculean effort if you want to achieve your objectives, and if you want to be truly successful.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Ask Doug.

In case you missed it, I encourage you to read my column from last week about what we can take away from the recent new highs in the domestic stock market. I also invite you to comment about my column in the space provided below my commentary.