Getting a new perspective on an old idea can be jarring.

Take the example of a world map.

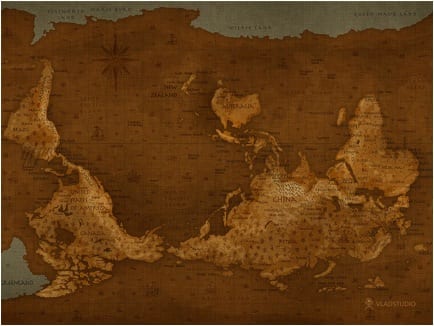

Just look at how different the map above looks compared to the one you’ve seen your entire life. (Source: http://vladstudio.deviantart.com/art/World-Map-Upside-Down-129838266)

How can something so familiar seem so disorienting?

First, it reminds you that ideas of “north” and “south” are arbitrary constructs.

Second, the map is also “rotated” so that China, Indonesia and Australia are in the center of the world. The United States and Europe are little more than “southern” backwaters.

You can apply a similar shift in perspective to looking at the U.S. economy.

In an open economy — such as the United States and, to a lesser extent, the European Union — political borders are artificial, and almost irrelevant, in getting a handle on areas driving economic growth.

U.S. Economy: ‘Asian Tigers’ in the U.S. Heartland

The U.S. economy grew at just 1.8% in 2013 and contracted an eye popping 2.9% in Q1.

That made it by far the worst-performing major economy in the world.

But the United States is a big country, and different parts are growing at different rates. Thanks to the boom in mining and the shale energy revolution, some parts are growing faster than the Asian Tigers.

North Dakota’s economy grew at 9.7% last year. About the size of Bulgaria, North Dakota would be among fastest-growing economies in the world. Wyoming next door grew by 7.6%, followed by West Virginia and Oklahoma. Even Texas’ hefty $1.4 trillion economy — about the size of Spain’s economy — grew at a solid 3.8%.

Clearly, some parts of the United States are doing better than others.

In fact, it’s almost deceptive to even think of the U.S. economy in terms of states.

It is better to look at the United States as the summation of various “mega regions.”

Richard Florida and his colleagues at the Martin Prosperity Institute identified 40 contiguous lighted areas across the planet with more than one major city or metropolitan region that produced more than $100 billion in economic output. The United States alone has 12 of these areas.

Indeed, a casual glance at the satellite image above confirms that there is a lot more economic activity going on in some parts of the United States than others.

Here are some of Florida’s surprising conclusions:

- The Boston-Washington corridor has a bigger gross domestic product (GDP) than Germany. If it were a separate country, this region would be the fourth-largest economy in the world, after the United States, China and Japan. Not bad for a population of only 57 million.

- The size of the Chicago-Pittsburgh corridor’s economy is about the same as the United Kingdom or Brazil. Its 41 million inhabitants live in an economy larger than that of Russia. Alone, the region would be the world’s seventh-largest economy.

- Southern California’s population of 21.8 million generates a larger GDP than all of Mexico, and it alone would rank among the world’s top 15 economies.

All told, a dozen U.S. mega-regions produce more than $13 trillion dollars in economic output, equal to three-quarters of America’s total GDP.

Take away these mega regions, and you don’t have a whole lot left.

Tectonic Shifts in the U.S. Economy

Dig deeper into what’s been happening over the past few years, and a couple of surprising trends emerge.

For all of its current economic heft, the Boston-Washington corridor is also the least dynamic in the United States. The Virginia and Maryland economies were stagnant in 2013. New York and Connecticut all grew by less than 1%.

According to a recent study by IHS Global Insight, which looked at cities rather than mega regions, almost all of the big-growth areas for the United States over the remainder of the decade stem from the South and West.

IHS projects the fastest rate of economic growth among Top 100 Metro Areas through 2020 as:

- Austin-Round Rock-San Marcos, Texas — 4.4%

- Raleigh-Cary, North Carolina — 4.3 %

- Fayetteville-Springdale-Rogers, Arkansas-Missouri — 4.2%

- Riverside-San Bernardino-Ontario, California — 4.2%

- Durham-Chapel Hill, North Carolina — 4.1%.

Personally, I was surprised to see that two of the top five cities are in North Carolina.

That said, both cities are in Richard Florida’s Charlotte-Atlanta cluster — a region of 22 million people that includes Atlanta, Georgia; Raleigh, North Carolina; and Birmingham, Alabama. With a combined economic output of more than $1 trillion, this cluster’s economy is bigger than South Korea’s and places it among the world’s fifteen largest economies.

The Road Ahead

Much like turning a world map upside down, looking at the U.S. economy as a collection of states and mega regions changes your perspective.

It also highlights fundamental shifts in the U.S. economy masked by nationwide statistics.

Some parts of the United States are clearly more dynamic than others. And they also correlate with certain characteristics. Of the 21 growth-leading metro regions covered in the IHS Global Insight study, six are in Texas and four in Florida.

And what do these regions have in common? Warm weather, light regulation and low taxes.

On the flipside, mega regions like the Boston-Washington corridor, with its high regulation and taxation, have surprisingly a lot in common with low-growth Europe.

Project out even further into the future, and it’s hard to escape the conclusion that the region is set to follow Europe’s fate as an economic laggard.

And that will stay true, no matter how you flip your world map.

In case you missed it, I encourage you to read my e-letter column from last week about ‘bond king’ Bill Gross’ favorite investment. I also invite you to comment in the space provided below.