When markets are collared in a well-defined trading range, one way to manage steady returns is to implement an active covered-call strategy that incorporates stocks that one might not own for the intermediate term if, for reasons like Brexit, the market is hit by sudden and powerful selling pressure.

We live in a world of more frequent terrorist attacks, political upheaval, sectarian warfare and natural disasters. Many of these events occur when markets are closed, but they can have a wide-ranging and immediate influence on the direction of equity markets. As has been the case in almost all the moments of crisis that the U.S. stock market has had to contend with, with each blow-off brought about by panic selling, the major averages have recovered within a relatively short period of time thereafter.

We hear time and time again ad nauseam about the doom and gloom of the total collapse of global equity markets from the fear-mongering newsletter writers who make their living casting doubt on the human experience in all of its forms. And while some of the dire warnings are grounded in long-term structural issues, such as the growing amounts of debt that central banks and developed governments are generating on their balance sheets, to conclude that there is no good end or solution to these concerns is, in my view, myopic and fanatically negative, almost to the point of being fatalistic.

Sadly, this approach to carving out a living in the financial publishing business, that takes such a dark view of the world, fails to consider how, during the course of human history, men and woman of character have overcome conditions that would have otherwise seemed impossible. When 56 men signed the Declaration of Independence on July 4, 1776, they risked their lives and their small collection of colonies to defy the almighty and powerful British forces that seemed capable of devouring them at every turn. But this week, we celebrate our 240th birthday as a free nation because the men and women of that time overcame the impossible.

When that same kind of fortitude is applied to financial matters such as balancing budgets, implementing a simplified tax code, being responsible for entitlement spending and balancing self-reliance with benevolence, good things can and will happen that are more aligned with fairness and that don’t compromise competition. But this kind of re-engineering of the political process from the current messed-up state of affairs will take time, and it explains why, according to most investment surveys, this is a relatively unloved stock market.

There is a general feeling that all of the above concerns will come home to roost. Those worries have kept a lid on this secular bull market to prevent it from breaking above its all-time closing high of 2,130 set on May 2, 2015.

After the markets have regained all of the losses incurred from the Brexit-related sell-off, the S&P will once again be knocking on the door of an upside breakout. With global interest rates continuing to move lower, capital flows into equities are likely to fuel enough momentum that a new high could be in store for the month of July and set in motion a summer rally that could bring a tremendous amount of money out of the bond market and off the sidelines.

Then again, if we see the more negative reaction to earnings, such as what has occurred for market-leading stocks like FedEx, Adobe, Monsanto and Nike that have been hit by headwinds from a strong dollar and are seeing reduced demand creeping into third-quarter guidance, the market may find itself mired in the ongoing trading range for some time to come. Against this fluid set of market forces, income investors who are starving for yield and who want to stay out of the junk bond market or long-term-dated fixed income can indeed purchase crème de la crème blue-chip growth stocks in companies with AAA-rated balance sheets and that have phenomenal records of growing dividends by 10-20% per year.

In doing so, investors will find select names usually priced well above $100 per share that, quite frankly, ties up a lot of capital just to take a small position. What is a good strategy for this particular situation is to apply an option strategy known as a “bull call spread” that, in concept, is buying call options on big name stocks while simultaneously selling out-of-the-money calls to generate immediate income and a defined total return.

The selling of covered calls against stocks insulates a stock position from downside risk to the amount of the call option premium received when selling calls against an underlying stock position. For every $1.00 of call premium received, the break-even level for the underlying stock is reduced by that same $1.00 per share.

The same is true for a bull call spread. The most common practice of using bull call spreads can be implemented by buying an at-the-money call option while simultaneously writing/selling a higher-striking out-of-the-money call option of the same underlying security and the same expiration month.

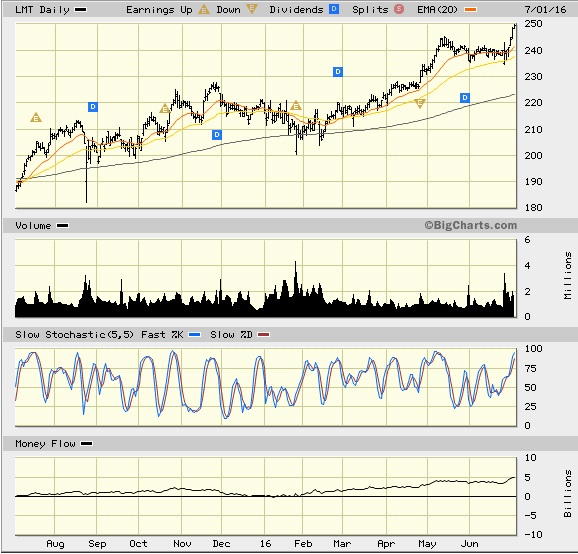

I take it one step further. My custom bull call spread formula is to buy a long-date, deep-in-the-money call on a stock such as Lockheed Martin (LMT), which trades around $250 per share, and pair it with selling a short-term, out-of-the-money call to bring in some “instant income.” The idea is to repeat this exercise every month to fashion a lucrative stream of steady monthly income against a portfolio of the very best stocks that are vastly outperforming the broad market and index investing.

Why spend $25,000 to own only 100 shares of Lockheed Martin paying an annual dividend yield of 2.8% when you can control that same 100 shares of stock at a price of $220 for the next year and a half for only $3,500 while generating $300 per month in income off of that same $3,500? That’s better than 8.5% per month in call premium that, over the course of a year, brings in $3,600 cash, minus commissions. This exciting income production strategy leverages heavyweight names incurring selling volatility with covered calls. To put that strategy into effect, I am launching a new and bold advisory service called Instant Income Trader.

If this kind of income production gets your juices flowing, you’re not alone. I invite you to click here to learn more about it and get on board the Instant Income Trader train, as it is just leaving the station this week from Eagle Financial Publications with its inaugural first weekly issue. The strategy is tailor-made for this kind of a market, which makes it a timely service and one deserving of every serious income investor’s consideration, especially those on the hunt for risk-adjusted outsized yield.

In case you missed it, I encourage you to read my e-letter column from last week about how Brexit could affect dividend payments here in the United States. I also invite you to comment in the space provided below.